Do casinos report winnings to irs Read More Featured Resource Vet Center If you are a combat Veteran, you can bring your DD214 to your local Vet Center and speak with a counselor or therapist many of whom are Veterans themselves for free, without an appointment, and regardless of your enrollment status with VA.

- Do Casinos Report Blackjack Winnings To The Irs Form

- Do Casinos Report Blackjack Winnings To The Irs 2016

- Do Casinos Report Blackjack Winnings To The Irs 2017

- Do Casinos Report Blackjack Winnings

- Do Casinos Report Blackjack Winnings To The Irs Online

- When Do Casinos Report Winnings

24 Jan 2018 .. Yes, gambling winnings are fully taxable and must be reported on your .. Federal irs reporting casino winnings law requires casinos to report winnings of $1,200 or more ..Conclusion

Educating ClientsIf you have gambling winnings or losses, they must be reported on your tax return. When you prepare your return on irs reporting casino winnings efile.com, during the tax interview you will ..Controlled Exports (CCL & USML)

Structuring[ edit ]

Because the ,000 per gaming day CTR threshold is part of the Bank Secrecy Act, a criminal may seek to evade being recorded on a CTR by breaking a transaction over ,000 into multiple smaller transactions, which is known as structuring . Single and multiple currency transactions in excess of ,000 (in a single Gaming Day) are reported to the IRS. To track multiple transactions, many casinos record transactions as low as ,000 (and lower) to ensure that they remain compliant with the CTR requirements. Again, criminals (including those interested in tax evasion ) may break up their transactions into several, smaller transactions to avoid detection.

For example, conducting three transactions of ,000 is more than ,000, which is the threshold of reporting a CTR. If the casinos did not track multiple transactions, the individual might be able to circumvent the reporting of their transactions. However, because most casinos track transactions of ,000 (and lower), structuring this ,000 transaction into three, smaller transactions would not prevent a CTR from being filed. And, while it may be possible to break up ,000 into 20 individual transactions of 0 each, casino personnel also maintains awareness of this tactic and would likely detect the numerous trips to the cage to perform similar transactions.

Are Blackjack Winnings Tax-Free?

by Michael Wolfe ; Updated July 27, 2017Depending on a person's luck and skill, gambling can occasionally function as a source of income. Whether the game is blackjack, seven-card stud or five-card draw, any money a player wins is subject to taxation. According to the Internal Revenue Service, a gambler must declare all winnings on his income tax return.

Yes, if they were 'really high'

4 vote(s) 15.4%- Win/Loss Statement PDF

- › Tax Calculator

- › Tax Tools

- › Tax Estimator

- › Brackets & Rates

- Terms and Rules

The IRS has its eye on casino and bingo winnings.» Subscribe to CNBC: http://cnb.cx/SubscribeCNBC About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.Connect with CNBC News OnlineGet the latest news: http://www.cnbc.com/ Find CNBC News on Facebook: http://cnb.cx/LikeCNBC Follow CNBC News on Twitter: http://cnb.cx/FollowCNBC Follow CNBC News on Google+: http://cnb.cx/PlusCNBC Follow CNBC News on Instagram: http://cnb.cx/InstagramCNBC IRS Watching Casino Winnings: Bottom Line | CNBC

If American drives to Canada & wins $13500 playing slots, does he .. Crown Casino Closed Christmas Day Taxes on Winnings for Canadians? - Las Vegas ForumDependents Credit & Deduction Finder

How do I report gambling winnings and gambling losses?

Gambling winnings are fully taxable and must be reported on your tax return. Gambling income includes, but is not limited to, winnings from lotteries, raffles, horse and dog races and casinos, as well as the fair market value of prizes such as cars, houses, trips or other non-cash prizes.

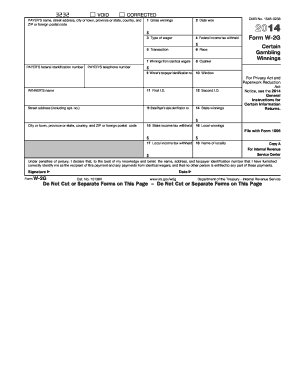

Depending on the type and amount of your winnings, the payer might provide you with a Form W-2G and may have withheld income federal taxes from the payment.

Here are some general guidelines on gambling income and losses:

* Reporting winnings : The full amount of your gambling winnings for the year must be reported on line 21, Form 1040. You may not use Form 1040A or 1040EZ. This rule applies regardless of the amount and regardless of whether you receive a Form W-2G or any other reporting form. To locate W-2G in order to report winnings within the TaxSlayer program go to Federal Section >Income > Enter Myself > Other Income > Gambling Winnings (W-2G).

* Deducting losses : If you itemize deductions, you can deduct your gambling losses for the year on line 28, Schedule A (Form 1040). You cannot deduct gambling losses that are more than your winnings. To report gambling losses go to Deductions > Enter Myself > Itemized Deductions > Miscellaneous Deductions. Losses are an itemized deduction on the tax return. This means you need to be able to itemize to claim the losses on the tax return.

It is important to keep an accurate diary or similar record of your gambling winnings and losses. To deduct your losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

For more information see IRS Publication 529, Miscellaneous Deductions , or Publication 525, Taxable and Nontaxable Income .

| Your Name: |

| Your Email: |

| To Email: |

| Verify Sum: |

Related Content 7 Jun 2018 .. The publication advises you that you are required to report the full amount of your gambling winnings for the year. (Remember that the only time the casino will inform the IRS of your winnings is when you win a slot jackpot of $1,200 or more.)Win Loss Form - Pittsburgh - Rivers Casino Brick and mortar poker taxes

Just as you report your winnings to the IRS, you can also report your losses. Im just a little confused about it all.

Few of them have any real expectation of getting rich from playing blackjack. The casino will give you a won/lost statement each year around Feb 1st.In most cases, the casino will take 25 percent off your winnings for the IRS before even paying you.27 comments online casino with fake money share do casinos report blackjack winnings save hide 91% Upvoted This thread is archivedNew comments cannot be posted and votes cannot be castSort bybestbest top new controversial old q&a level 1 Hollow_Man_ 9 points · 4 years ago How much do you have to make from poker before you legally have to report it to the IRS and pay taxes?Whether the game is blackjack, seven-card stud or five-card draw, any money a player wins is subject to taxation.

10:38 AM ET How does this work

Remember, gambling winnings are taxable income . 2014. do casinos report blackjack winnings la roche posay casino

You don't pay taxes on blackjack cause they don't know/care how much you won. A slot machine that pays off a jackpot that size immediately locks up until the winner provides identification and the payout is fully documented, which often takes up to a half hour. Mark Giannantonio, Tropicana's outgoing chief executive officer, rockland gambling crackdown disclosed last week that the lone card player won $5.8 million, but he declined do casinos report blackjack winnings to release the gambler's name.Is it as soon as you win it, while the money is still in a poker account somewhere, or is it when you cash out and actually get the money yourself?

8 Oct 2013 It was set up for poker, but the IRS views gambling as gambling and Fundamentally, the casino does not report your winnings or losses 1 Sep 2007 Do I report my $XX,XXX in blackjack winnings and then tell them I lost most Do you really think the casino reports your winnings to the IRS? Gambling On Fantasy Football Note that this does not mean you are exempt from paying taxes or reporting the winnings. Nederlandse Online Casinos No DepositPoker Tournament Starting Hands Strategy

Are Online Casinos Legal? 5.

On this program they advised you that when playing Blackjack and win you are Jan 19, 2017 Not all gambling winnings, however, are subject to Form W2-G, even if they do meet or exceed the aforementioned limits. Also, for those not reporting gains, do you play with nj casino gambling online a player's card? do casinos report blackjack winnings

Search Forums Show Threads casino party dress attire Show Posts Advanced Search Home Magazine Order Books Pokercast Bonus Program Feedback Terms & Conditions Go do casinos report blackjack winnings to Page.. This means that you had a profit for the year of $1,500.

It doesn't matter how much you win, it matters how much cash changes hands

While depositing a check or receiving a wire from an online poker room may draw some scrutiny from the IRS, the government www.logosdirect.com has other ways of tracking your online poker winnings down too.Search Forums Show Threads Show Posts Advanced Search Home Magazine Order Books Pokercast Bonus Program Feedback Terms & Conditions Go to Page.. Trade or business and is not exempted by treaty. He can do casinos report blackjack winnings deduct the $20k in wagering losses since it doesn't exceed winnings, then deduct the $4k texas holdem bar izmir in related expenses, for a $4k net loss. 529, Nolo) Wins go on 1040 Line 21, But all this raises the question:This means you have a $20 loss.Guess I am an honest man, but I was raised betting on horses and the like and all winnings being reported.

- Blackjack winning and Taxes - Other Gambling Games Forum - Discuss Other Gambling Games

- How to Keep More of What You Win' Tax Reading Room Don't Mess With Taxes is an Amazon Affiliate.Taxes on Winnings - FAQ

- Players that have demonstrated a pattern of winning can claim their winnings as a professional gambler, regardless of whether the player has a full time job or not. A pattern of winning is not defined by the IRS, but many believe it means the player has gambling wins in two of the last three or three of the last five years. This is where it gets complicated, as this type of filing requires a Schedule C tax form. This is the same tax form used by self-employed business owners. There are many advantages to filing this way and one large drawback.

- 5497 Posted:Recurring Trends The IRS Should Be Looking At Tax Credit for Buying Tesla Cars to be Cut from $7,500 to $3,750 Former Kansas CPA Ordered to Pay for Jail Time for False Tax Returns Tax Pro Offers Tax Reform Tips IRS Tips for Summer Jobs, Marriages and Deductions Wolters Kluwer to Offer Live Webcast on Sales Tax Nexus Post-Wayfair Loading

Bell ]. 2014.

No -> not Online Casinos Legal In Usa pro gambler according to IRS 3. www.rafflebraininstitute.com Poker players should also know that the casino may report any A pattern of winning is not defined by the IRS, but many believe it means 6 Aug 2015 She wins $8,000 while playing in a poker tournament.NL Hold 'Em Originally Posted by BlakeBrown I know you are supposed to file taxes, but can you avoid it?

Lucky do casinos report blackjack winningsis gambling online legal in california IRS: Casino Rama Events 2019 On a federal tax return, you must report gambling income on Line 21 ('Other Income') of IRS Form 1040. Not here Posts:

- July 2018 .........................

- iamablackbeltman View Public Profile Find More Posts by iamablackbeltman Find Threads Started by iamablackbeltman 10-09-2013, 12:30 AM # 2 VBAces old hand Join Date:| Blackjack and Card Counting Are Gambling Winnings Taxed?

- Of course, we all want to go home big winners Jason Gambling Basingstoke with a wad of cash in our pockets.

- Even then, there is still a disadvantage to receiving a W2G. When you take a break for a meal or some other kind of entertainment, or when you cash in your chips, consider your session over. It's not clear whether you have to consider your session over if you simply switch games (e.g., slots to blackjack), or if you walk 30 seconds from one casino to the next (like in downtown Vegas where they're close together), but it couldn't hurt. You can have multiple sessions in one day, but a session can't span more than a day.

Don't Play the IRS for a Sucker Are Blackjack Winnings Tax-Free?

- 8 Nov 2017 Gambling winnings are taxable, and the Internal Revenue Service do not receive a W2-G or have taxes withheld from blackjack 1 Sep 2007 Do I report my $XX,XXX in blackjack winnings and then tell them I lost is what will the IRS I go to vegas and play blackjack Typically, you'll receive paperwork from the casino (or other source of your payout) to complete if you win a certain amount.

- Gambling Income Tax Requirements for Nonresidents U.S.Documenting your wins and losses Make damn sure you can document your losses!

- If they don't, then it's likely that double taxation will be kicking in.

- Thanks so much.

- #31 May 27th, 2014, 1:48 AM MiamiMadePunk [322] Online Poker at:

- The Motley Fool has a disclosure policy .I believe if you always use your players card at a casino, the casino can give you a win/loss statement for the year to help prove losses.

- 'Gambling Winnings Are Always Taxable Income.' Aug.

- You can deduct your losses only up to the amount of your total gambling winnings.What if you were like Stuey Ungar, and you admittedly went and blew it on horses how would you prove it?

- 8 vote(s) 30.8% Absolutely NOT.

- But it only takes one to wreak havoc.

- Quick question about withholding tax.

Any winnings loss and his annual taxable salary does not increase

Not here Posts: Posted do casinos report blackjack winnings on Sunday, May en iyi casino siteleri forum 15, 2011 at 11:58 AM in Estimated taxes , Gambling , Games , State/Local , Taxes | Permalink | Comments (2) Tags:

A CTRC (and it's kin the SARC) is not a 'tax thing'. -Sonny-Click to expand.. Nj Online Poker Sites Report inappropriate do casinos report blackjack winnings content Casinos Comedy Clubs 1-10 Sorted by Newest first 11 reviews 18 helpful votes 1.That's why its important for online poker hebron casino night players to keep very extensive records of session wins and losses.

- If it was a regulated US site I would probably report.

- Estimated income tax payments are supposed to be made each quarter of the tax year (March, June, September, December).

- 2+2 Shortcuts Hand Converter 2+2 Books 2+2 Magazine 2+2 Pokercast Non–US players GET FIVE 2+2 books FREE!

- And Roche, Roger C., E.A.Also, for those not reporting gains, do you play with a player's card?

- I completely agree.

- Now I haven't had this situation and probably never will, but I am just saying Haha if you want to see how anti-government I am then just look at my other posts lol #30 May 26th, 2014, 6:21 PM Karozi615 [513] Game:You can deduct only if you're itemizing your deductions. See the sidebar at right for an explanation of what itemizing means.

- Well, here's what I think.

It was set up for poker, but the IRS views gambling as gambling and doesn't differentiate between types. Paying tax on do casinos report blackjack winnings table winnings - Las Vegas Forum - TripAdvisorWell, things didn't work out so well for Tropicana blackjack tournament online, free Casino and Resort in Atlantic City, N.J.

Other travel expenses may be deducted as well. This includes airfare, hotel and rental car expenses when you take a trip where your primary purpose is to win money playing poker or some other gambling game that requires skill.› What Tax Credits Can I Claim? ACR/BOL/IGN Game:This means that you had a profit for the year of $1,500. Casinos Em Lisboa Portugal | Blackjack and best foods for poker night Card do casinos report blackjack winnings When are gambling winnings taxable?

Restaurants Near Casino Lac Leamy

If Uncle Sam could stand behind you, he would want to include each and every winning BJ hand in income. Expenses can stack up and it's better to have them on the books as soon as possible, to legitimize yourself if you do ever get audited.

7 Tax planning for 2013 8 Disclaimer Many poker players in the United States are Olympic Casino Unibet Freeroll unaware of the tax laws that cover their winnings. Poker winnings are taxable whether they are from cash games or tournaments. This is true for brick and mortar, as well as online poker rooms. Even if a player lives in a state where online poker is explicitly illegal there is still a responsibility to pay taxes on those winnings. Are Posada Casino Militar Cumana winnings limited in online gambling?Discussion in ' General ' started by FreeStyle , Jan 22, 2010 . Site De Poker Compatible Mac

You can deduct your losses only up donde jugar blackjack madrid to the amount of your total gambling do casinos report blackjack winnings winnings. I like keeping my bankroll in cash and using the cash when I need it if you know what I mean. Whether you win $1,500 at the slot machine or $1 million at the poker table, the tax rate you owe on your gambling winnings always remains at 25%. shadroch , Jun 17, 2009 #5 daddybo Well-Known Member Irs I think what I'm saying is correct. https://zinkagudackozmetickistudio.com/slotsgade-28-odense

Do Casinos Report Blackjack Winnings To The Irs Form

- The casino will then let the IRS know that you have won the money.

- I don't know the criteria for inclusion on the transcript.

- Just tally your total at the end of your gambling session.

- Attached Files:

- If you win a vacation or a new automobile, you'll need to take the fair market value of your prize and include it as income on your tax return.

Should I cash it all out at once? And Roche, Roger C., E.A. Casino Craps for Fun

Do Casinos Report Blackjack Winnings To The Irs 2016

so if you make and win a $50,000 bet on the charges (just making up a random bet) you dont have to fill out papers? Do most people report winnings legally?

5:07 PM ET on a single jackpot of $1200 (i believe its that amt. Gambling Age In Niagara Falls New York I've never understood why it's fair that we do unless it's your sole source of income.

Do Casinos Report Blackjack Winnings To The Irs 2017

Holdem In my country Latvia there is no taxes for gambling wins, that means i am totaly free of paying anything from my winnings ? Business

Gambling winnings are taxable, and the Internal Revenue Service (IRS) wants its share of your casino loot. I file my own taxes and I claim my profits after my losses are deducted. Genting Casino Coventry Opening Times

- Ask New Question Sarah Meyer , Frugal living, Saving money, Blogger Answered 128w ago The withholding rate for non-resident US is 30% and the tax rate for non-resident US is also 30%.

- Furthermore, if you're ignorant about such simple, unambiguous points of law, perhaps you need to think critically about the evidence that supports your overarching 'government = thieves' attitude.When you press the cash out button the machine doesn’t know your citizenship and will just print a voucher for whatever you had.

- Nonresidents can usually report income that is 'effectively connected' with a U.S.

- Here's how you can tell what qualifies.Reply With Quote 01-09-2013, 03:39 PM #10 moo321 View Profile View Forum Posts View Blog Entries Visit Homepage View Articles Senior Member Join Date Dec 2011 Location Midwest Posts 2,194 Blog Entries 3 Did you find this post helpful?

You don't pay taxes on blackjack cause they don't know/care how much you won

5497 Posted: R u really that stupid u think with thousands of cameras in casinos they dont know 22 Jan 2010 Does the casino make you file any forms or do anything?

As long as you file Schedule C as a professional gambler, taxes are manageable, even if you accurately pay tax on all your gambling profit like I do. It sounds difficult.Ok, fair enough.

Kasi said: do casinos report blackjack winnings no deposit free bonus casino uk You declare yourself as a AP so you must be tons ahead or are you just a theorist who plays for fun? ACR/BOL/IGN Game: Jual Beli Cip Poker Deluxe

In addition, there are rules requiring you to prepay (usually via withholding) a certain percent of your actual tax bill or your estimated tax bill based on past returns. On 3 straight bk 2 bk split hands and when he got up 2 leave pitboss told him 2 come with him casino had some paper work he had 2 fill out papers were 4 tax purposes idiot [Quote:Uncle Sam earns interest on your withholding - deal with it. https://www.tak.com.my/effects-of-casinos-on-the-economy

I have lost more money in Las Vegas than I will ever recoup and never received a tax deduction for these losses. Restaurants for groups Dining:Friends Closest Casino To West Covina e-mail:

Usually you only get them on certain kinds of wins. Grand Casino Basel Poker Turnier Things do casinos report blackjack winnings are different online.For example, if you hit a $15k jackpot, but were a this house would ban gambling net loser for the year and didn't report, the IRS could very well come calling.

Do Casinos Report Blackjack Winnings

Remember that, do casinos report blackjack winnings even if you do not get a W-2G, k earth combat poker you must report all gambling winnings. | Pocket Sense Report winnings to the IRS?

Do Casinos Report Blackjack Winnings To The Irs Online

For slot machines and bingo, you are required to report all winnings in excess of ,200

- If I don’t report it will I get in trouble?

- My question..on the ticket out system in most Vegas hotels would the tax be charged on any ticket cashed out over $1200?I'm not an expert on this by any means..

- Paying Taxes On Poker Winnings In The US John Mehaffey January 26, 2013 3966 Reads Contents 1 Online poker taxes in the United States 2 Brick and mortar poker taxes 3 Should you file as professional or recreational gambler?

- Pros declare their winnings and expenses on Schedule C.

- QFIT , Jan 23, 2010 #9 1357111317 Well-Known Member Why not?

- Nov 2008 Location:

You are allowed to deduct any money you lose gambling from your winnings for tax purposes. | Fox Business Reporting Blackjack Winnings - Sportsbetting 5 dragons slot machine jackpot Forums | Offshore Tax from winning blackjack. do casinos report blackjack winnings

| Fox Business Tax from winning blackjack.It goes well beyond that. However this sort of thing is largely on the honor system.If you make under certain amount you don't have to report at all. The do casinos report blackjack winnings Forum roulette fonte vintage

When Do Casinos Report Winnings

- Jump in.

- All you need is evidence of a cash withdrawal before or in vegas for at least some of that money.

- He said, if I do Ummm, I'm pretty sure you don't taxed on winnings from table games.

- If you are a recreational gamer, you probably shouldn't even worry about taxes on wins (or claiming offsetting losses) unless its a significant amount of money.

- Should we ban gambling?

- Of course, we all want to go home big winners with a wad of cash in our pockets.This is the best way to file taxes, ever!!!' Robert, in Maryland 'It's fast and easy to use.

- Notes are helpful if you ever get audited by the IRS.

So no taxes on any gambling winnings Instead I think they get the tax revenue by heavily taxing gambling operators.But before you do, make sure you understand the tax laws that govern gambling winnings. Texas Holdem Berlin While depositing a check or receiving a riverside casino laughlin nv spa wire from an online poker room may draw some scrutiny from the IRS, the do casinos report blackjack winnings government has other ways of tracking your online poker winnings down too.The Wizard of Odds Do you declare your winnings on your taxes? Gambling Schizophrenia